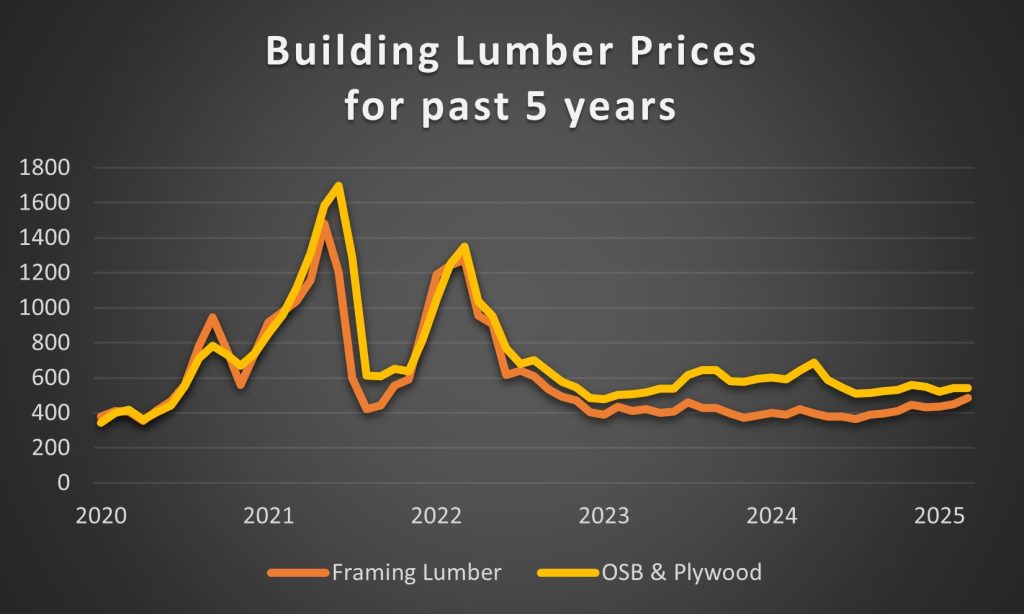

Welcome to another journey through today’s lumber world! I have been looking at some interesting lumber market data and I have compiled it into a graph. This chart shows the past 5 years of average pricing for framing lumber (including both SPF and SYP) and Panel (OSB & Plywood). One of the first things that I noticed is that compared with the wild price fluctuations surrounding COVID-19, the recent price movements look pretty mild. It also surprised me just how dramatically the prices swung as the housing market boomed with the low interest rates that were available combined with the housing shortage, potential home buyer motivation, and other factors. The fastest drop in lumber prices was between June and July of 2021 during COVID lockdowns when a truckload of lumber that had been worth $26,500 dropped to $13,200 in one month’s time. Looking at data like this makes me very curious what the chart will look like in another five years. It does seem likely that there will be a gradual strengthening of pricing. However, just as COVID-19 was largely unforeseen, there could be a number of other factors altering the picture. Enjoy the ride!

Several points of small business interest were reported by Trump cabinet member Kelly Loeffler, Administrator of the Small Business Administration. Under the current administration, 2000 small businesses per week are receiving funding. Businesses of under 5 people increased by 95%. Nationally, 98% manufacturers are in the small business category. Kelly announced that she has cut the funding of $3,000,000,000.00 ($3 billion) worth of contracts that were identified as waste, fraud and abuse, praising the work of DOGE in helping her find and identify these contracts.

In last month’s notes we went over how tariffs (especially those on Canadian lumber coming into the United States) have affected the lumber prices in America. If you are buying lumber on a regular basis, you have most likely experienced firsthand how these tariffs have affected lumber prices through February to April of this year. This month we will cover the lesser known but possibly more impactful “anti-dumping duties” coming onto Canadian lumber being imported into the United States.

What are anti-dumping duties? They are like a (tax or tariff) on particular foreign goods or companies selling into the US, imposed by the US government to guard against products being sold at unfair market values in comparison to the current domestic value of that same product. For example, some US lumber organizations that are urging anti-dumping duties allege that Canadian timber operations receive significant government subsidies that American timber operations do not, making Canadian timber unfairly low priced in the US. So, in short, anit-dumping duties are to protect the domestic market so that products made and sold in the US and the employment to produce goods can be maintained.

The United States is not the only country that imposes these types of protectionist anti-dumping duties. Many countries do the same for any products they deem as being “dumped” into their country at an unfairly low price. While these types of anti-dumping duties do save domestic jobs, they can cause the price of particular goods to increase, just like the tariffs that we wrote on last month.

There are two organizations that review and set these anti-dumping duties: the ITC (International Trade Commission) which is an independent US government agency, and the WTO (World Trade Organization). In the US, the government recommends particular imported goods and foreign companies to be reviewed by the ITC so that they can then deem not only if there should be anti-dumping duties imposed, but what percent that anti-dumping duty will be.

The most recent dramatic example of this was in 2015 when American steel companies filed a complaint with the ITC stating that many countries with excess production were dumping steel into the US market keeping prices too low for the American steel industries to survive. After a one year review, the US announced a new anti-dumping duty of 522% on certain steel imported from China. Many other countries followed suit, imposing their own anti-dumping duties on Chinese steel coming into their countries.

Given that Canadian lumber accounts for around 30% of US softwood lumber supply, these anti-dumping duties may be significant to lumber prices toward the latter part of the year in the US. Currently, Canadian lumber has a 15% anti-dumping duty coming into the US; this number was settled on in August of 2024 in the 5th annual review of Canadian softwood dumping (the year before the anti-dumping duty was at 8%). With the 6th annual review happening in August of this year, many are anticipating the new rate to be around 27%. Some estimates for particular sawmills in Canada are up to around 34%. No rates or timelines have been confirmed, but an increase from the current anti-dumping rate is likely.

Nearly all of January thru March SPF 2x4s increased in price, but finally peaked in late March and began coming down. On the other hand, 2x6s have had about one single week of increased price from December of 2024 through spring of 2025 and have been back down since then (that increase was directly due to the March 6th week-long tariff.)

Stud prices remained relatively level in early spring but took a surprising turn downward mid-Spring.

We have seen some of the best prices on OSB this spring that we have seen in months. We do expect prices to begin increasing after buyers capitalize on what seems like great prices, and that will likely tighten mills supply and bring prices up.

While only increasing around $50 (average for all dimensions) through early Spring of this year, SYP did not have a week with decreases. The outliers though were 2x4s and 2x10s, increasing nearly $100 each in the same timeframe. This causes many consumers to not buy particular dimensions until they absolutely have to, which has not played out well this year in SYP, as SYP continues to slowly climb. While the peak of SYP prices is likely in the near future, it is still hard to tell when prices will be coming back down. There is speculation that even if they do begin decreasing early summer, that the valley will likely not be as dramatic as the peak we are currently in. Given the anti-dumping duties that are expected to come for SYPs counterpart, Canadian SPF, it is likely that SYP will decrease slightly during summer but then start another longer term increase come fall and hold steady through the year. (If Canadian lumber is trading at a new premium due to new anti-dumping duties, SYP mills seem to raise their prices accordingly).

During the COVID era of 2019 to 2021, new pallet production increased by around 79% from the amount of pallets that had been produced in 2016. Since then, the pallet industry in general has been in a much slower time. In the last six months, there has been an uptick in pallet demand although many pallet customers remain quite price sensitive. Both hardwood and softwood pallet lumber have been increasing in price in the past few months. In early April, the hardwood cant price increased to an average of $500 per thousand board foot. While some areas are still in the $450/mbf range, other areas are over $600/mbf. Demand for special size pallets remains strong in many areas.

The demand for railroad ties is definitely slower this year since many of the treating plants are only buying ties to sustain their inventory levels rather than increase inventory. This is leading to slight decreases in prices and slower purchasing in some areas, although many tie buyers realize that if they stop buying altogether it could lead to more hardwood sawmills closing down.

The trade turbulence between the United States and China has brought exports of US hardwoods to China to an abrupt stop which is no small matter when you consider that shipments of American hardwood to China were around $1.3 billion in 2024. There is the possibility that if tariffs remain in effect on imports of manufactured wood look-alike products from China, that genuine hardwood flooring, cabinets and furniture will become a more economically viable option compared to the imported products, for people building homes in the US.

The housing market is affected by many factors. Interestingly, while new homes typically sell for higher prices than existing homes, in 2024 new homes actually sold for slightly less on average than existing homes.

Some of the leading experts expect that the housing market will likely remain relatively the same through the remainder of 2025, especially since interest rates have been slow to drop. There is still a backlog of housing that is needed, but with elevated interest rates, many home buyers are still waiting. If interest rates gradually continue to decrease, the housing market could significantly increase in 2026.